The financial management of the special line logistics has always been the pain point of the small micro logistics company. The financial staff has low professionalism, the company's financial management is not standardized, and the professional financial training content is not suitable for the actual business characteristics of the company. . The financial personnel of many logistics companies not only have imperfect accounting management, but also have an effective analysis of the company's financial and business conditions and put forward reasonable proposals for the company's operation and management.

Therefore, as a special line logistics, it is necessary to let the financial personnel systematically learn the basic accounting knowledge of logistics, understand the financial management mode of the dedicated logistics company, clarify the duties and work contents of the financial management position of the logistics company, and learn the financial management process and standardization of the special logistics company. , bookkeeping, reconciliation, checkout method; master the management and control skills of cash, accounts receivable, accounts payable, cost and expenses, learn and master the preparation methods of accounting statements and the knowledge of the company's financial status analysis, and comprehensively improve the finance of logistics companies The professional quality and ability of personnel to regulate the financial management of the special line logistics company.

First, the main points of the financial management of the special line logistics

1. For the operation and management of the dedicated logistics, the business is the foundation, the finance is the core, and the management is fundamental. All business management activities must be carried out and carried out around these three points.

2. The financial process must be synchronized with the business process. As long as any financial changes occur in any business process, the financial department must immediately notify the financial department to handle the financial and accounting changes of the relevant data to ensure the synchronization of the financial process and the business process. In order to ensure the accuracy, timeliness and correctness of financial data, otherwise it will not be able to draw a "real account." At the same time, management will find problems and solve problems in time.

3, must establish a standardized financial management system, maintain a healthy financial situation, must have the ability to effectively control business and risk through financial information.

4. The financial management of the special line logistics should focus on the management of funds, the management of accounts payable, the control of cost and expenses, the reconciliation management with the branch, the reconciliation management of customers and the reconciliation management with the drivers of the cart. Improve financial statements and conduct effective financial analysis to rationalize the company's operations and management.

Second, the main points of the internal account management of the special line logistics

1. Cash and bank deposit management

2. Accounts receivable management (freight, collection, return, monthly settlement, other receivables)

3. Receipt management (signing, verification, handover, settlement)

4. Accounts payable management (receiving money, returning driver's freight, loading and unloading fees, other payables)

5. Cost and expense management (main business cost, management fee, financial expenses, other business costs)

6. Reconciliation management (daily, monthly, and year-end settlement)

Branch reconciliation - to freight, collection, return, transfer, delivery, loading and unloading, forklift, service, damage

Customer Reconciliation - Collection, Billing, Freight Settlement

Driver reconciliation - return shipping charges, cargo damage, insurance

7. Dynamic management of inventory goods (state of the company, branch inventory, and payment)

8. Financial control (reasonable control of cost and expenses, prevention and control of financial risks)

9, internal accounting

10. Manage the “four accounts” (general ledger, detailed ledger, cash journal, bank deposit journal)

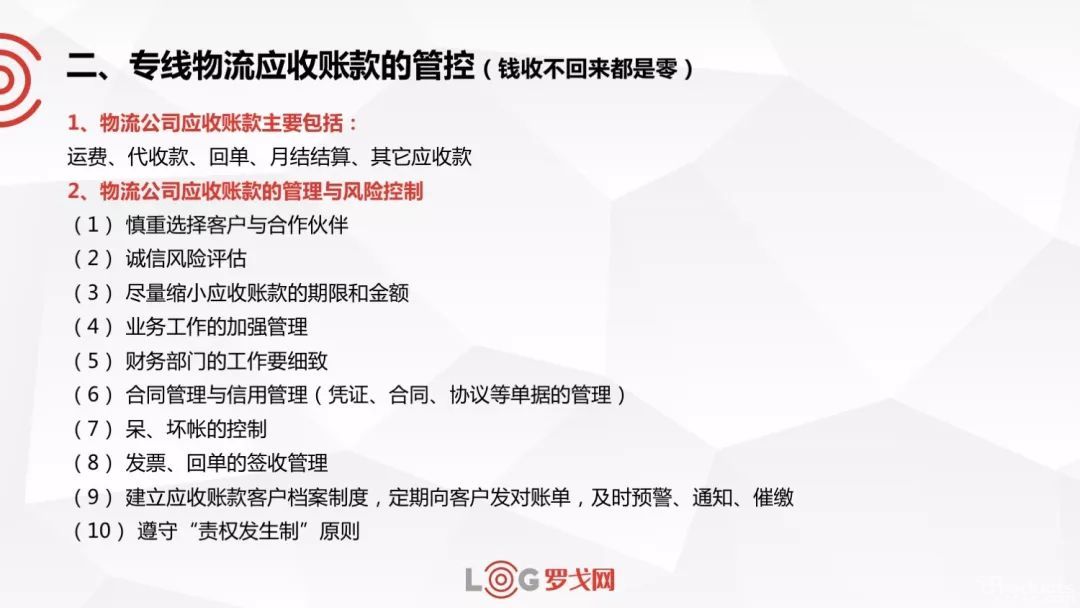

Third, the management of the special line logistics accounts receivable

Fourth, the special line logistics company and branch company reconciliation management points

Cooperative branch: It only checks, verifies, and manages the expenses incurred in the business and manages its rationality.

Self-operated branch office: not only to check, verify, and account for the expenses incurred in the business, but also to further control its rationality, and also to supervise and manage other daily expenses.

1. Verify the execution of the big ticket, confirm the correctness and accuracy of the big ticket (coordinate with the customer service department), and pay attention to the change of the contract order:

(1) Changes in freight settlement methods and amounts

(2) Changes in delivery methods

(3) Change of delivery address

(4) Changes in collection and amount

(5) Changes in the settlement method and amount of the carrier driver

Verification and confirmation of various expenses:

Verification of the service fee, loading and unloading fee, forklift fee, transit fee, delivery fee, and cargo damage liability of the branch.

2. Very important check and management of collection and return receipts: timely collection and return of collection and collection, correct receipt, handover and settlement of receipts.

3. Verify the final settlement result:

(1) Confirmation of payment

(2) Call---The self-operated branch must deposit the current day's income cash into the head office bank account after the daily business settlement.

(3) Call for payment of the branch company as required to prevent financial risks

(4) Checkout with the branch on a regular basis as required

V. Several issues needing attention in the reconciliation management of the special line logistics company

1, the accuracy of the big ticket

(1) The big ticket is an important basis for the financial reconciliation of the logistics company. All the small orders must be attached to the back of each ticket list. The original return must be copied and attached. The ordinary return order can be filled in and settled by the financial personnel responsible for the management of the receipt.

(2) The accuracy of the big ticket is the guarantee of the accuracy of financial reconciliation

(3) The business department must ensure the accuracy and timeliness of the big ticket--strictly control the three sources

(4) The big ticket is a summary of the business work, and is the written basis for the financial supervision and inspection of the business work.

2. The business process of logistics must be the same as the financial process (the contract order content should be changed and processed in time)

3. The finance of logistics must be integrated into and penetrated into the business process (you must understand the business process and grasp the occurrence of the cost of each link).

4. Prevention and control of financial risks (management of accounts receivable)

Branch company freight, collection and collection of timely settlement and collection (in the case of more returns, better control)

Correct receipt, return and settlement of the return receipt

Effective evaluation of customer integrity

5. Supervision of the reasonableness of cost and expenses (the company shall formulate uniform cost standards, cargo damage, maintenance processing and implementation)

Sixth, the analysis of three financial statements of special line logistics

A balance sheet is a financial statement that reflects a company's financial position at a particular date and is an important statement. It includes three aspects:

A resource owned or controlled by an enterprise that is expected to bring economic benefits to the enterprise, that is, the assets of the enterprise.

The current obligation of the company's past transactions or events that are expected to result in the outflow of the company's economic interests, that is, the liabilities of the enterprise.

The economic benefit enjoyed by the business owner in the corporate assets, that is, the owner's equity.

The contents of these three aspects are arranged according to the accounting equation “assets = liabilities + owner's equity” and further classified. The balance sheet mainly reveals the following financial information:

The occupation of corporate funds, that is, the assets of the enterprise, including the total assets, the structure and distribution of assets, etc.

The source of corporate funds. For companies, the funds that form corporate assets are

The relationship between assets and liabilities.

The income statement is a financial statement that reflects the formation of business results in a certain accounting period. It reflects the income and costs of the company and the resulting profits.

The cash flow statement is based on cash (including cash on hand and deposits that can be used for payment at any time) and cash equivalents (generally an investment that can be realized in the next three months with little risk of changes in value), reflecting the period of the business. The financial statements of cash (including the above-mentioned cash and cash equivalents, the same below) inflows, outflows and changes in net flows.

It reveals the source and amount of cash inflows of enterprises during a certain period, the way and amount of cash outflows, and the net flow of cash. It reflects the financial status of enterprises more deeply and objectively from the perspective of cash and cash equivalents. It will help to further reveal the ability of enterprises to generate cash, solvency and ability to pay, evaluate the quality of profits, and predict future cash flows. The table is divided into three parts:

Cash flow from operating activities

Investment activity cash flow

Cash flow from financing activities

VII. Main contents and methods of analysis of financial health status of logistics companies

Financial analysis is the judgment and evaluation of financial status and operating results. The main basis is the financial statements. Mainly through the analysis of the company's solvency, profitability, development potential, etc., to timely diagnose the "health" of the enterprise, to provide a basis for corporate decision-making and daily management

We will reply you within 24 hours